It is 6 months since the initial impact of Covid-19 hit Ireland like a thunder bolt. We have adapted to our new normal and all the changes this has brought. For a lot of people this has included working at home, meetings on-line, less travel and no commuting. This has given people more time to pursue leisure and other activities as well as thinking about their life plan.

In a recent survey, when people were asked if they were doing more of a range of activities, spending time with family had increased significantly as had hobbies and exercise. Things like the reduction in international travel, more flexible working arrangement and working from home were initially short-term affects but now seem to be here to stay.

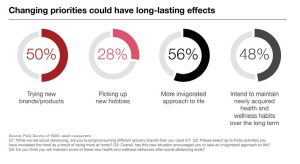

The sudden abrupt disruption that happened earlier this year, allowed us to take time to re-evaluate our lives. With more leisure time spent with family and on new hobbies, collectively we may be experiencing a reconsidering of priorities. While these may start as personal in nature, there will be an economic impact from this re-prioritisation.

How many of us gave up habits and behaviours that we now don’t wish to return to? How many of us now place a higher priority on a quality of lifestyle? Would you like to work less or maybe retire sooner? Perhaps look at a phased retirement or a total change in career? Changes in working conditions, working from home and flexibility of hours have also affected our view on where we live and the types of property, we wish to live in.

This is where you need your income and assets working hard for you, so that these dreams can become a reality. A thoughtful and well-constructed financial life plan can help you work through your changed priorities and help you understand what is now most important to you in life.

At Brazil Financial (The Money Mentor) we pride ourselves on working closely with our financial life planning clients to create and implement a clear financial life roadmap based on what is truly important in their lives. Our financial life planning service ‘Life Without Limits’ not only helps you to understand what is most important to you in life and why it’s important. We will help you to identify what needs to be in place to maintain the lifestyle you and your family want. Our approach looks at where you are at today and where you want to be in the future.

Our 5-step process, which we call DREAM allows you time to focus on the life plan with the financial plan being developed only once you are clear about your priorities and goals. You can find out more detail here but in summary the steps are:

I recently gave some examples of how this approach has really helped people in their day to day lives . First was the case of a client who had always assumed he would work until retirement. Changes in his priorities led him to consider reviewing his situation, with a view to taking a step back 5 years earlier. Once we moved through the steps above and this goal became clear we were able to put the financial plan in place to achieve it.

Another example is a client in his early 40’s who had time to reassess his career choice and direction over the past 6 months. His conclusion was that he ultimately wished to retrain and pursue a very different avenue. Again, once this was clear, we were able to review the financial situation. A plan was then put in place that will allow him to pursue this goal in the very near future.

A financial plan is only as good as the life plan that it supports. Discover what really matters to you and realise the priorities. Then the financial plan can be put into place. And we will be with you on every step of the journey.

Depending on your age, the State retirement age in Ireland is bet...